Year-end Posting Periods

Frequently Asked Questions before and after Year-end

It’s that time of the year again where many SAP Business One users ask us for help with year-end posting periods issues. The common questions are:

1. I’m trying to post A/P and A/R invoices but getting an error

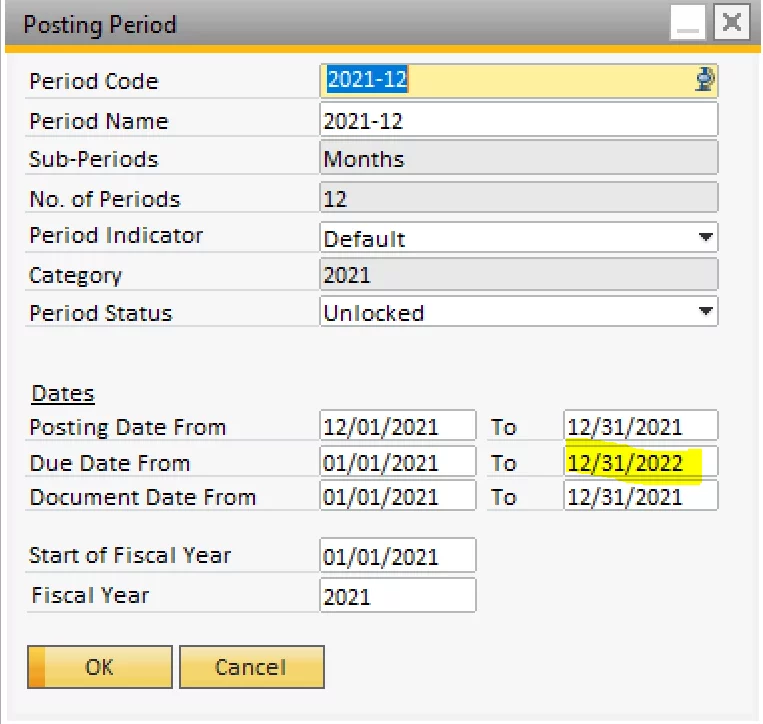

The reason is almost always that the December period has a To Due Date set to 12/31/2021 (current year) but your A/R or A/P Invoice has a due date that calculates out to January or later in the next year. The simple fix is to edit the December posting period in Administration -> System Initialization -> Posting Periods and edit the To Due Date to at least 1/31/2022 (or later). Once you do this, you will get past the posting error.

2. How do I setup the accounting periods for next year

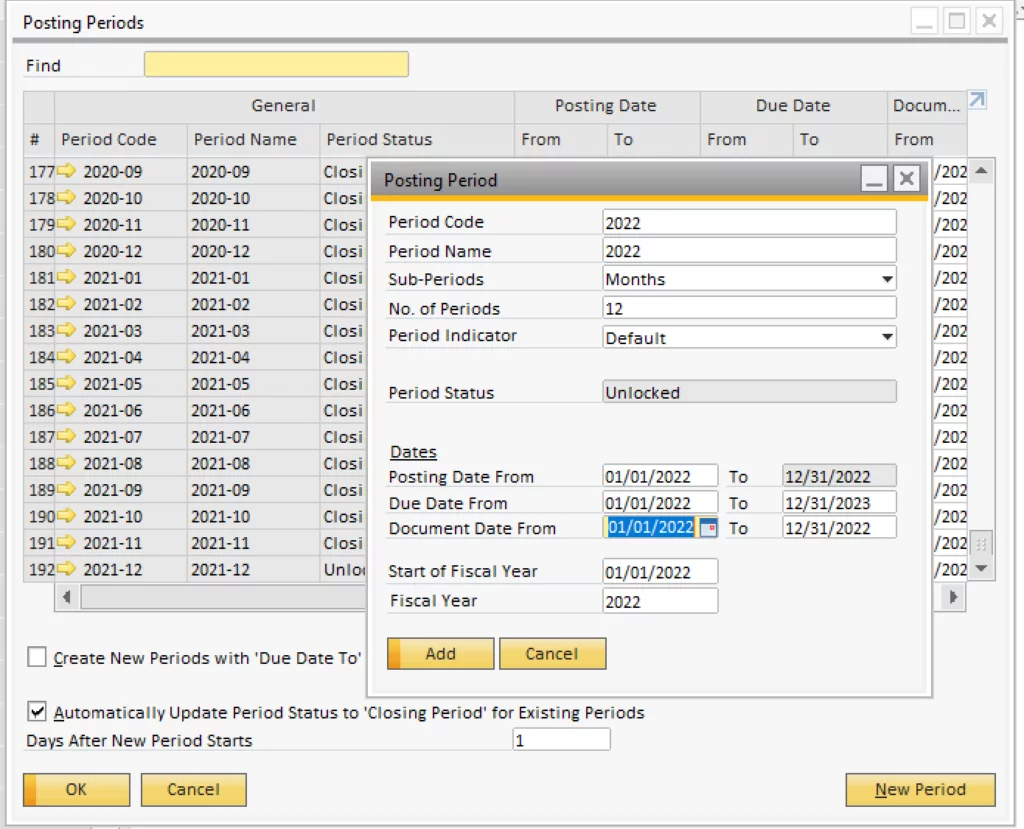

This is quite easy in SAP Business One. Again, go to Administration -> System Initialization -> Posting Periods and click New Period. Type a Period Code and Period Name (usually something like the year – 2022, for example), pick the period interval (e.g., Months). Usually, if prior periods are set up correctly, most of the other fields below automatically populate correctly. TIP: Change the To Due Date to something later than the default to avoid the due date issue next year. We normally recommend something further out such as 12/31/2023.

3. Should I lock my accounting periods?

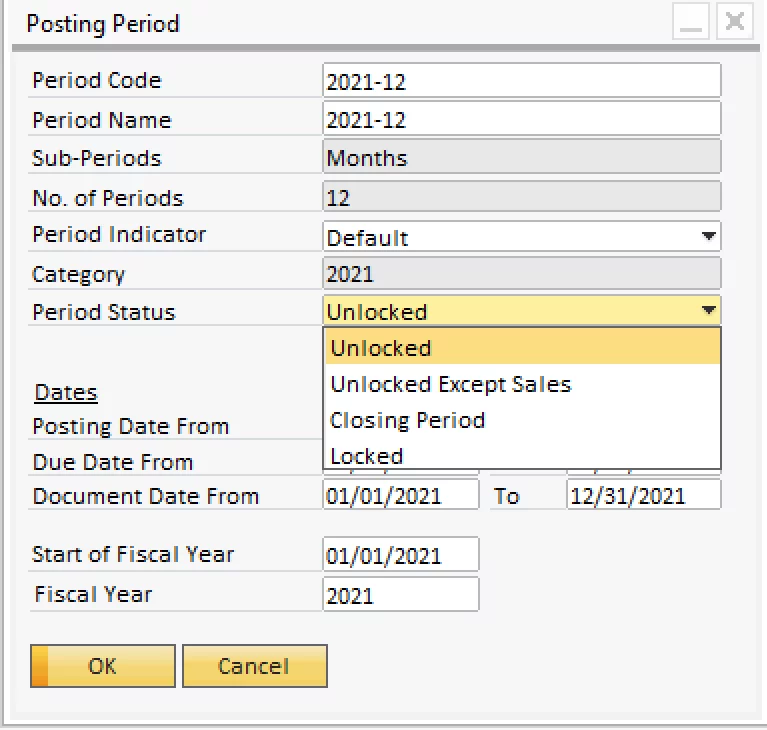

This is optional. Best practices are usually to set the period status to “Closing Period” or “Unlocked Except Sales” depending on the status. The latter is usually selected when accounting is still working on finishing up the month-end-close. “Closing Period” is only used when you want to run the Administration -> Utilities -> Period End Closing at year-end.

4. How do I close the year?

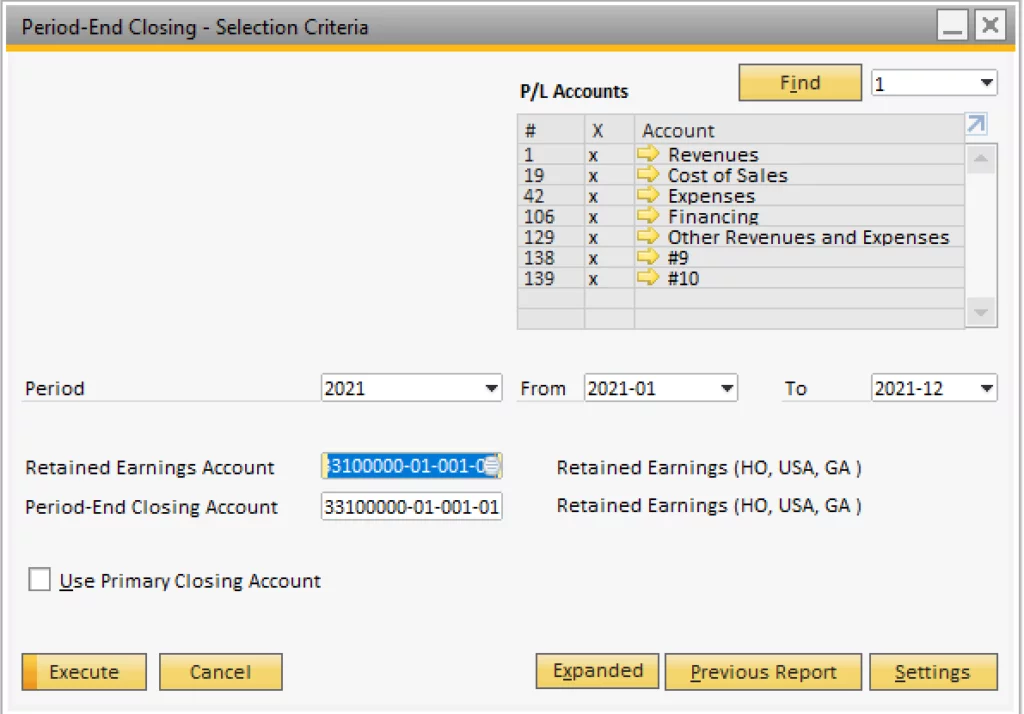

This couldn’t be easier. When you’re ready to close your P&L to Equity, simply open Administration -> Utilities -> Period End Closing, select the Fiscal Year, From Period, and To Period (if you don’t see the periods, you need to set them to closing period. You only need to select the first and last month of the fiscal year and only they need to be set to Closing Periods. Select your Retained Earning and Period End Closing Account.

SAP will close each Income Statement account to a Current Period Profit account on the last day of the year and then move each to Retained Earnings on the first day of the next year. Most of our customers don’t need to do this so they select one Retained Earnings Account in both spots. The next screen will show you every Income Statement Account the has a balance as of Year-End and will create the closing entries after you click Execute. TIP: you can perform this as many times are you like – for example once after you are ready to close and again after your auditor verifies your statements and posts any adjusting entries.

Keep calm and have a happy year end

Have a Happy Year-End and New Year. If you have any questions or issues, please feel free to open a ticket or contact us for assistance.

Innovation at Heart

As the most experienced SAP Business One Gold Partner in North America, we help scale and support your business, every step of the way. Our expertise extends beyond SAP Business One and ERP. Our customers enjoy having a single provider for all their needs. No matter how your business system requirements grow and change, we are there to assist you.

Third Wave’s implementation process and consulting team has created a customer retention level average of 98.7% year over year and is the only partner to achieve 100% customer retention. We have a 95% implementation success rate. Contact us and see how we can help you get the most out of SAP Business One.

Talk to an expert today and discuss how we can help you get the most out of SAP Business One

Versago and Bizweaver

SAP Business One runs better with Versago and Bizweaver, our innovative portal and business process automation platform for modern operations.

Extend the power of SAP with a connected workforce and smart integrated eCommerce, CRM, EDI, and 3PL with SAP Business One.